Rendered at 11:54:16 05/01/25

Free Shipping

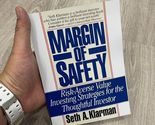

Margin of Safety Book : Risk-Averse Value Investing Strategies for the Thoughtfu

£138.55 GBP

Ships from

United States

Shipping options

Offer policy

OBO - Seller accepts offers on this item.

Details

Return policy

Full refund available within 90 days

Purchase protection

Payment options

PayPal accepted

PayPal Credit accepted

Venmo accepted

PayPal, MasterCard, Visa, Discover, and American Express accepted

Maestro accepted

Amazon Pay accepted

Nuvei accepted

Shipping options

Offer policy

OBO - Seller accepts offers on this item.

Details

Return policy

Full refund available within 90 days

Purchase protection

Payment options

PayPal accepted

PayPal Credit accepted

Venmo accepted

PayPal, MasterCard, Visa, Discover, and American Express accepted

Maestro accepted

Amazon Pay accepted

Nuvei accepted

Item traits

| Category: | |

|---|---|

| Quantity Available: |

2 in stock |

| Condition: |

Brand New |

| ISBN: |

978-0887305108 |

| Author: |

Seth A. Klarman |

| Book Title: |

Margin of Safety book |

| Language: |

English |

| Topic: |

Value investing strategies |

| Format: |

Paperback |

| Country/Region of Manufacture: |

United States |

| Signed: |

No |

| Number of Pages: |

250 |

Listing details

| Shipping discount: |

Seller pays shipping for this item. |

|---|---|

| Posted for sale: |

April 29 |

| Item number: |

1743265102 |

Item description

Margin of Safety" by Seth Klarman is a classic and highly sought-after book on value investing. Written by one of the most successful hedge fund managers of our time, the book emphasizes a risk-averse approach to investing, focusing on capital preservation and careful analysis.

Klarman explains why traditional investment strategies often fail and presents a disciplined method centered on buying undervalued securities with a margin of safety — meaning investments that are priced well below their intrinsic value, thus reducing the downside risk.

Unlike typical market speculation, Klarman advocates for rational, long-term thinking, patience, and skepticism of market trends. The book draws from real examples and the teachings of legendary investors like Benjamin Graham.

Though out of print and notoriously expensive in the secondary market, it remains a must-read for serious investors who prioritize thoughtful decision-making over hype and short-term gains.

Added to your wish list!

- Margin of Safety Book : Risk-Averse Value Investing Strategies for the Thoughtfu

- 2 in stock

- Price negotiable

- Handling time 3 days.

- Returns/refunds accepted

Get an item reminder

We'll email you a link to your item now and follow up with a single reminder (if you'd like one). That's it! No spam, no hassle.

Already have an account?

Log in and add this item to your wish list.